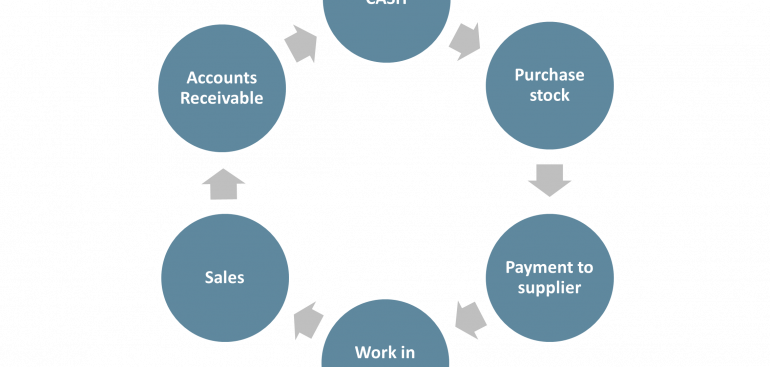

The link between profit and cash is timing; known as the Working Capital Cycle. For a service provider, you sell your services and invoice the customer. The value sits in your accounts receivable ledger until the customer pays you. Many service providers don’t actually measure their work in progress, but that doesn’t mean they don’t have it. It takes time to complete a job before it can be invoiced (unless you’re invoicing on acceptance of a quote or proposal).

For a retailer or manufacturer, you purchase stock or materials and pay the supplier – sometimes immediately, somethings on credit. The stock then sits on your shelves or the materials get turned into product – we call this work in progress. You then make a sale and invoice the customer and the value of the sale sits in your accounts receivable ledger until you get paid.

During challenging economic times we find:

1.Stock turn reduces because customers are buying less or are choosing less expensive lines, so take care with stock lines affected by obsolescence. Be aware of changing customer buying patterns and adapt quickly.

2.Debtors increase as customers take longer to pay, so be alert and proactive. Ensure you undertake credit checks and offer payment options.

3.Creditors are fighting their own cashflow problems, so are being more assertive and insisting credit terms are adhered to.

All of these have a negative impact on cashflow.